Money Mistakes Med Students Make and How to Avoid Them: Poll

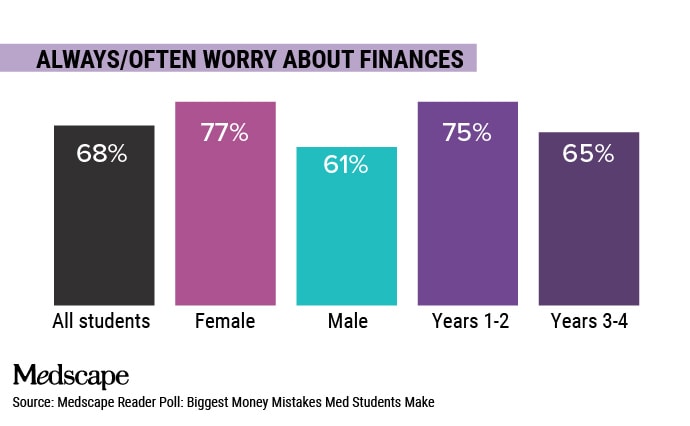

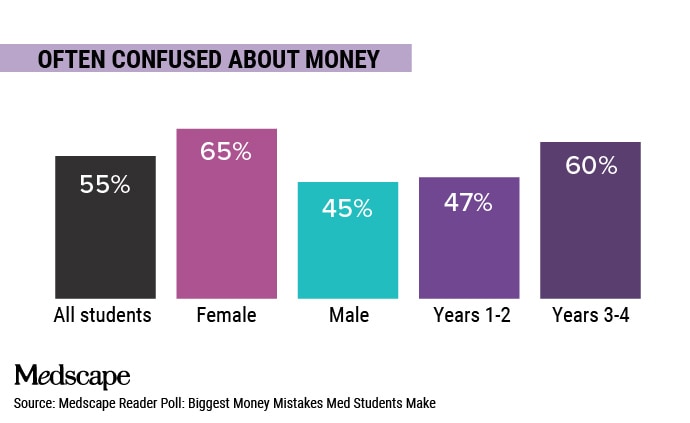

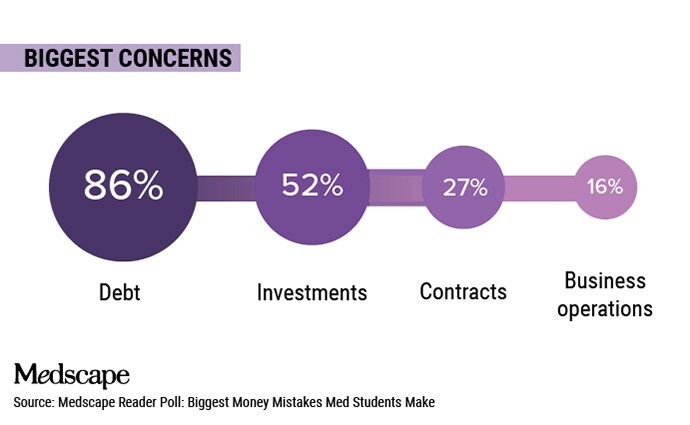

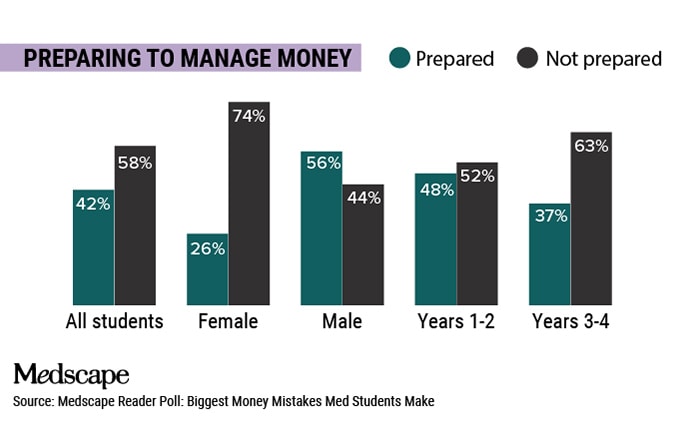

Debt and investments are the top concerns of US medical students polled by Medscape Medical News about financial issues. More than half of those polled said they often are confused about money, and only two in five feel prepared to manage it.

The poll stems from Medscape’s 2022 Medical Student Lifestyle Report, which showed that students want more information than they get in medical school about how to manage finances, debt, and contracts.

As part of the poll, we asked students what money mistakes they regret or fear making. We also consulted financial planners who work with young physicians and doctors-in- training to weigh in on the findings and offer advice to the future physicians about managing their money more effectively.

The 151 US medical students who responded to the poll were equally divided by gender, with third-year students making up the largest group.

Among the most common money blunders cited by US poll respondents were spending too much, mostly on food; taking out student loans; credit card debt; and buying items they did not need.

“Probably the biggest mistake I made was not refinancing my loans until the second year I was an attending,” said one poll respondent. “It cost me more than $50,000 in extra interest payments by keeping my loans federal. That said, I liked having the safety net of the income-based payment plans while I was in residency. … Nowadays there are payment plans that incentivize keeping loans federal, but for me it turned out to be a very costly decision.”

James M. Dahle, MD, founder of The White Coat Investor website, said he was very concerned about the 55% of US medical students who said they were often confused about money. But he said he was more alarmed by the 90% who worry about money because he doesn’t believe they have anything to worry about. “Med students should be worried about matching perhaps and being good doctors, but not about money,” he said. “That part is actually relatively easy (so long as you match). It’s just a matter of education.”

Dahle elaborates, “Once accepted to medical school you enter a long pipeline, but it has an almost guaranteed ending with a high-paying job. So long as doctors match into a residency, the money will be there to take care of student loans, et cetera, as long as they know how to use it. Education about their future job prospects, incomes, and how to take care of the student loans dramatically reduces financial worries.”

Dr James Dahle

From Dahle’s experience, medical students worry most about “how they will ever pay off all those student loans, but he believes that doctors can pay off their student loans within 5 years of completing residency if they commit to living like a resident until the loans are gone.

He explains that “means spending like you’re the average American family with something like $60,000 per year while earning like an attending physician (average physician income is $339,000). Even after paying lots more in taxes, you should still have something like $150,000 per year with which to build wealth, eg, paying off debt and investing.”

“Even $300,000 in student loans goes away very quickly if you’re throwing $10,000 a month at it.” And that’s not counting those who will have their federal student loans forgiven through Public Service Loan Forgiveness programs.

Still, poll respondents shared their concerns about “how to balance spending for ‘fun’ things when your entire income is loans,” according to one commenter. Another student cited worries about “not accounting for the difference in costs between 4 years of medical school and $3000 to apply to residency during the fourth year.”

One-third of the poll respondents were third-year students, 26% fourth-year, 23% second year, and 17% first-year students.

Financial planner Paul Morton, who advises young doctors, said of the poll results that students are accepting student loans and managing investments without being confident in their decisions. “Add the pressures of medical school testing, hospital rotations, and ultimately residency preparation to this, and it’s easy to understand why so many are confused and worried.”

Medical students’ concerns about student loans are warranted, Morton said. “As a financial planner, I never thought student loans would be one of [the] more complicated financial systems surrounding my clients’ planning.”

Paul Morton

But he has found that “the rules behind the federal student loans have changed so frequently and have become so specific that when a student accepts a loan, the original terms of the loan (eg, interest rate, payment terms, and possible forgiveness privileges) are almost destined to change once they finish medical school.”

Morton also noted students’ difficulty in communicating with student loan servicers, who themselves struggle to keep up with the changing rules, Morton added.

“It’s important to understand the student loans, but many medical students are so focused on medical training that the time and capacity to understand the student loan system can be difficult to muster.”

James Nutter

James Nutter, director of client experience for IM Wealth, said he always reminds medical students who feel the intense burden of medical school loans that their debt is an investment in their future.

“There aren’t many investments out there where one can invest $200,000 into a skill that can return them $6.5 million to $10 million through a career with little market risk involved,” Nutter said.

He advises students: “Know that you will pay them off successfully at a pace that is comfortable to you as an attending if you’re proactive and make a plan that aligns with you and your lifestyle.”

Among his other tips to help aspiring physicians manage their money:

-

Take a personal inventory of where your money behaviors stem from. Do I have views surrounding money that I cling to because of society, my parents, my childhood, or influences like FOMO (Fear of Missing Out) and social media? Why?

-

Calculate household cash flows, meaning money coming in and money going out monthly. This will create awareness about how much money they actually need to borrow vs what they think they need.

-

Identify your three unique core values and only make life and money decisions that are aligned with those values. Too many of us get caught keeping up with others who have different values in life.

Morton said disciplined budgeting and “a healthy savings rate is often the key to unlocking lifestyle and investment opportunities.”

The debt burden and current financial climate could be contributing to students’ interest in investing, he said. “An investment might seem like a rosy alternative to debt, yet it could be just as hazy and complicated of a topic as student loans.”

While investments are important, they likely won’t lead to a solid financial plan, Morton said. “Adding a protection component in legal documents [eg, trusts] and insurance along with an ongoing budgeting and saving strategy would help to materialize what most people would think a financial plan should be. Not every physician wants insurance or an estate plan, and that’s OK, too.”

He added that there are some doctors on blogs who tout successful investments. This may cause medical students to idealize investing without knowing much about it, he said. “The movies and media portray investing as a sexy endeavor. The reality is that for many individuals, investing for a long-term financial plan is much like watching paint dry — you just leave it alone for much of the time.”

Roni Robbins is an editor/writer for Medscape Business of Medicine covering medical students, residents, nurses, and physician assistants. She’s been published in WebMD, HuffPost, Forbes, NY Daily News, BioPharma Dive, MNN, Adweek, Healthline, and others. She’s also the author of Hands of Gold: One Man’s Quest to Find the Silver Lining in Misfortune.

For more news, follow Medscape on Facebook, Twitter, Instagram, and YouTube.

Source: Read Full Article